S. Treasury bonds—and to work out These fees, You will need to increase a unfold for Trader returns, as well as expenses from the CDC and SBA.

A merchant money progress is often one of several fastest different types of financing your business will get, and excellent credit typically isn’t demanded. Right here, your earlier profits (ordinarily through credit and debit playing cards, or on-line income) will likely be analyzed and, Should your business qualifies, you’ll get an progress versus long run gross sales.

Before implementing for any kind of funding, it’s essential to possess a sound business prepare. This should contain in depth monetary projections, a transparent description of your business model, and an indication of market place probable. Superior credit history scores and financial documents also improve your possibilities of securing funding.

Nevertheless based on meticulous investigate, the data we share won't represent authorized or professional suggestions or forecast, and shouldn't be addressed as a result. Corporation listings on This page DO NOT suggest endorsement.

You’ll ought to make an effort and a spotlight needed to locate the right lender husband or wife, CDC, and eventually, complete the lengthy and detailed application approach.

The choice of financing really should align using your business’s distinct needs and extensive-expression aims. Take into account factors like the amount of funding necessary, the purpose of the cash, repayment phrases, and the expense of borrowing.

Immediately after publishing our one-page application, most business proprietors see cash deposited inside 24 several hours on acceptance. It’s our honor that can help Nevada small businesses come across results, so contact us now to learn the way we may help guidance your business ambitions.

With a traditional lender, the application course of action can take weeks. Then, if you are authorized, you’ll probably wait around another a number of months for your loan resources to come by way of.

Kiah Treece is actually a accredited attorney and small business proprietor with expertise in real estate and financing. Her concentration is on demystifying personal debt that can help folks and business proprietors just take Charge of their finances.

Forbes Advisor adheres to stringent editorial integrity benchmarks. To the ideal of our expertise, all content material is exact as on the day posted, however offers contained herein may well not be readily available.

Find out how a small business loan can be used, the various loan varieties, and the way to apply for financing

Try to remember, the purpose is not simply to safe funding, but to pick a solution that supports sustainable progress and very long-time period accomplishment.

All businesses are unique and so are subject matter to approval and evaluation. The expected FICO score may be bigger dependant on your relationship with American Convey, credit score background, and other factors.

This more info staying said, SBA 504 loan prices are made up of two distinct curiosity costs—the speed to the CDC portion of the loan and the rate on the bank percentage of the loan. The SBA sets conventional, preset fees with the CDC percentage of the loan.

Jonathan Taylor Thomas Then & Now!

Jonathan Taylor Thomas Then & Now! Rick Moranis Then & Now!

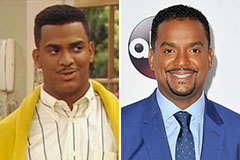

Rick Moranis Then & Now! Alfonso Ribeiro Then & Now!

Alfonso Ribeiro Then & Now! Jenna Jameson Then & Now!

Jenna Jameson Then & Now! Melissa Joan Hart Then & Now!

Melissa Joan Hart Then & Now!